When a tenant signs a lease it’s normally intended that they want to live in the property for twelve months or more. It’s often a common experience to see a tenant continue renting beyond the first twelve months but they go on a month-by-month lease. It is understandable as circumstances can change at it provides the tenant with the flexibility to leave the property on short notice. However during a...

Market insights

The COVID-19 crisis has caused much pain to health, livelihoods and working careers. The situation has called for many changes in the way people interact. The real estate industry is set to experience many changes particularly in the way it presents a property inspection. Property inspections are traditionally conducted to show potential tenants a property to lease or potential buyers a property to...

Common mistakes buyers make - and how to avoid them. Buying a home is one of the biggest commitments you’ll make in a lifetime. If you can get it right the first time, you’ll obviously increase the chances of adding more properties to your net wealth. In doing so this article may help you prevent some common mistakes buyers make. You may also enjoy our article on "First Home Buyers - 5...

Buying off-the-plan is a great way to enter or introduce yourself into the property market. However, can you sell off the plan before settlement? As buyer's advocates we source many properties for buyers and help them settle in the best means possible. However, during the construction phase, some buyer's personal circumstances change. These are often unavoidable and can cause their finances to...

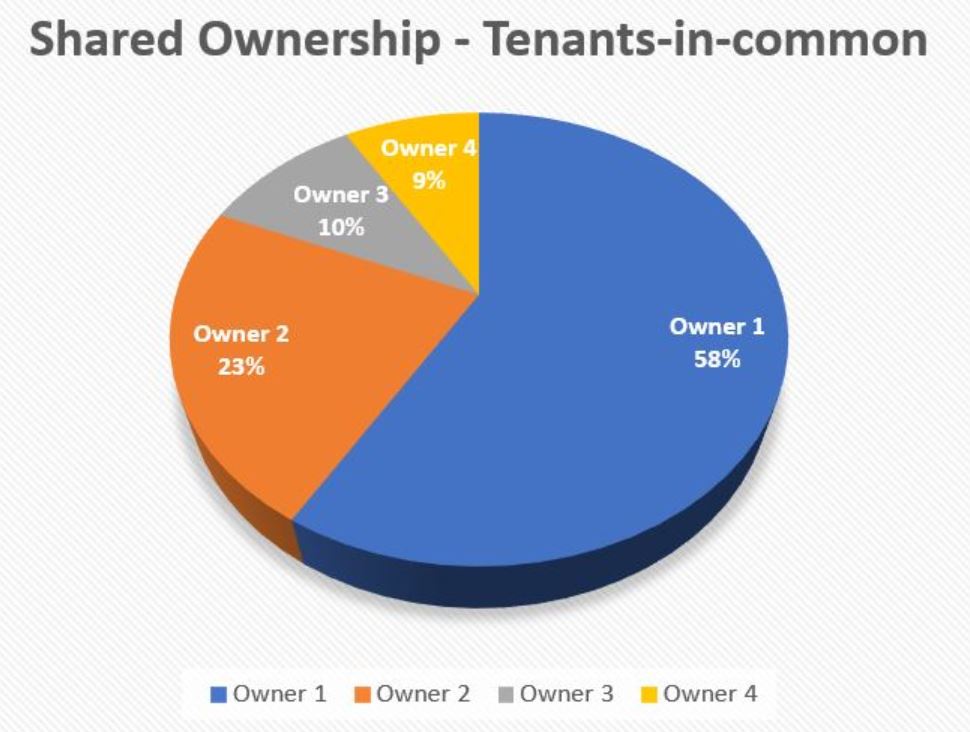

Co-ownership is a beneficial and affordable way for self-managed super funds (SMSFs) to acquire real estate. Superannuation law allows super fund members to co-invest within their super fund. The new Tenant in Common Exchange (ticX) provides an uncomplicated trading platform for co-owners. Until the development of ticX there was no trading platform for the sale and acquisition of tenants-in-common...

These days, not everybody wants to buy a property outright on their own. An alternative may be to purchase through a tenants in common. If you’re considering buying a house with a partner, however worried the relationship won’t last. The Tenants in Common Exchange (ticX) will provide you with a platform to sell your share. The ticX trading platform allows developers, builders, renovators and real...

Are you ready to build a new property? Is it for investment or to occupy? Regardless of the purpose, how do you choose the right builder is critical to gaining longevity, low maintenance and a well-presented property. How to choose the right builder Your motive may differ from others. You may want to miminise some costs for an investment property or you may want superior workmanship to raise your family....

How do valuers assess a property valuation? No matter if you purchase a brand new, off-the-plan or second-hand property, we are all in the mercy of the valuer. This is less relevant for a cash buyer, but for the most part, buyers require borrowed funds to complete their purchase. This means the bank will employ a valuer of their choice to complete property valuation. There are many professionals in...

Once you have nominated your house design, floor plans, builder and received your building permit, it’s time to watch your home start building. This is a very exciting time, but it can be a nervous one if you are not aware of the build process. In this article we take the opportunity to highlight the different construction stages to minimise your nerves and help you enjoy this special...

The property market reaches new heights in prices The Real Estate Institute of Victoria’s latest data reveals that metropolitan house values surpassed $850,000 for the first time. This result comes on the back of two consecutive quarters with growth of more than 3% each, the last time this occurred was in June 2017. REIV President Leah Calnan said the Victorian property market continues its strong...