How to avoid home buyer’s remorse. No doubt everyone has experienced it in one way or another. Even the more experienced property investors feel it on some purchases. It can even come to you when buying a car, a new tennis racquet, a dress or paying for some accommodation. There are different levels of buyer’s remorse. Purchasing a $300 tennis racquet would be seen as a lower scaled level...

Expert knowledge

Stamp duty concession for investors. The Victorian Government through the State Revenue Office has announced a land transfer (stamp) duty waiver for purchases of Victorian residential property with a dutiable value of up to $1 million. Please take some time to view the link State Revenue Office. Stamp duty concessions - here is a snapshot: For new residential properties, a 50% land transfer duty...

Auction clearance rates are the most viewed property statistic. In this market insight, we take the opportunity to help explain what they are and how to understand them. They are calculated for auctions scheduled during the week, ending each Sunday. It indicates the percentage of properties sold at auction using available data. The data also takes into consideration properties sold before...

At Crest Property Investments, we have been assisting buyers for many years, by sourcing brand new or off the plan properties. Our niche service as a buyers advocate also known as a buyers agent is quite different to a traditional real estate agent. Here we share the key differences between our buyers advocacy service and a real estate agent. Buyers agent: We act on behalf of the buyer We act in the...

Buying a property of any kind is a fine achievement in itself. You can purchase a property in a number of ownership types, including individuals, companies, and trusts. In this market insight, we explore the difference between joint ownership and tenants in common. The most common way to buy a property is with two people. These two people are often spouses. Having two people collectively can make it...

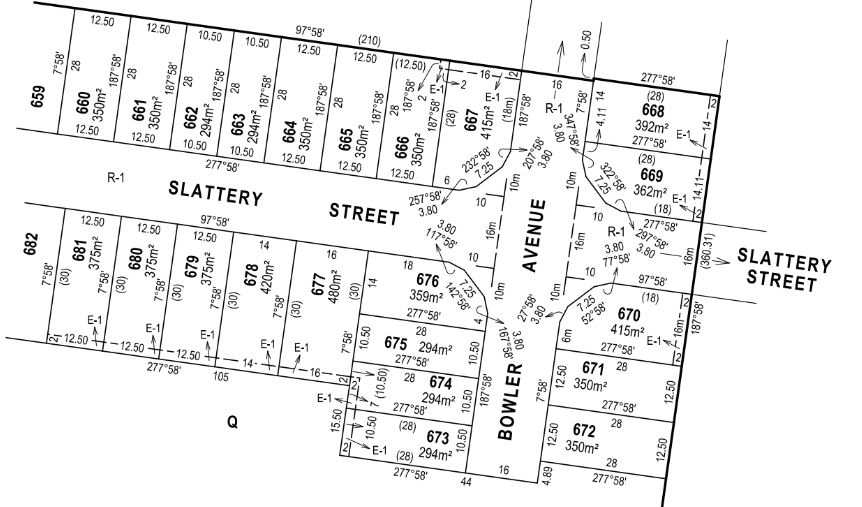

When buying a property, it's important to look at a number of items. One of those is understanding an easement on a property. Many people find it difficult to understand easements and the many legal problems that surround them. It is a complex area with some difficult terms and conditions. Here is some basic information to help. What is an easement? An easement is a section of land registered on your...

Direct property and direct shares are among the most popular investments to own. They both provide an investment return, but lets explore the advantages, disadvantages and what the main differences are between the two investment assets. Direct property For the purposes of this article we will discuss the advantages and disadvantages of residential property. A residential property includes houses, units,...

Sometimes a lender will provide a cash substitute to the seller on the buyer's behalf, with the intention that the buyer will later pay the deposit for the property at settlement. This is known as a deposit bond. Why use a deposit bond? This can be advantageous for a buyer as it provides additional time to organise their finances before settlement. A Deposit Bond is generally a prompt way of arranging...

Many of us fall into the category of buying a new property before your existing home has been sold. A bridging loan bridges the gap between securing a mortgage for a new property before an existing property is sold. It's very exciting when upgrading your home, but if it's subject to selling your current property, it can be an anxious and stressful wait. Aligning these two timelines to match can be...

It’s an exciting time buying a property. We have been lucky to witness many types of buyers succeed with property. However many have differing views and objectives. Regardless if you are a first home buyer, investor or owner occupier, there are some important questions you need to ask yourself before buying a property. Before buying, here are three questions that suit all buyers. 1 - How much money do I...