Buying an investment property can be challenging at the best of times. Purchasing a property you've never been to can be even more challenging. For many investors, buying interstate can be very difficult to accept. Both new and experienced investors can feel a mix of emotions. Purchasing a property you've never been to can feel like a greater risk. We all work hard to place ourselves in an investment...

Experienced investor

What are vacancy rates? If you have ever looked at buying an investment property, you are sure to have heard this terminology before. What are vacancy rates? Vacancy rates are the percentage of how many rental properties in a location or market are currently without a tenant or vacant. The rate is calculated by using the number of vacant properties, multiplying that number by 100, and dividing that...

Buying an investment property is a popular asset to own. Both new and experienced investors often have similar reasons why they wish to purchase an investment property. There are many advantages and disadvantages. Here were discuss and summarise them. Advantages of purchasing an investment property: The property market is generally more stable than other investment markets such as the share...

Land is a precious commodity. Some feel it’s the essence of property investment. Are you familiar with the term titled land? In this article we teach you what titled land is compared to untitled. In residential property, titled land is when the allotment has been officially recorded with the Land Registry. If your block is officially titled land it’s been granted a Certificate of Title. This...

A roof top terrace is a growing amenity among new modern apartments. Having an amazing view of the Dandenong mountains or twilight views of the Melbourne city skyline are undoubtedly a pleasure. However is it worth it? Some roof top terraces have teppanyaki kitchen appliances or barbecues, a garden terrace and outdoor furniture. Larger apartment buildings can also include a swimming pool, cinema or...

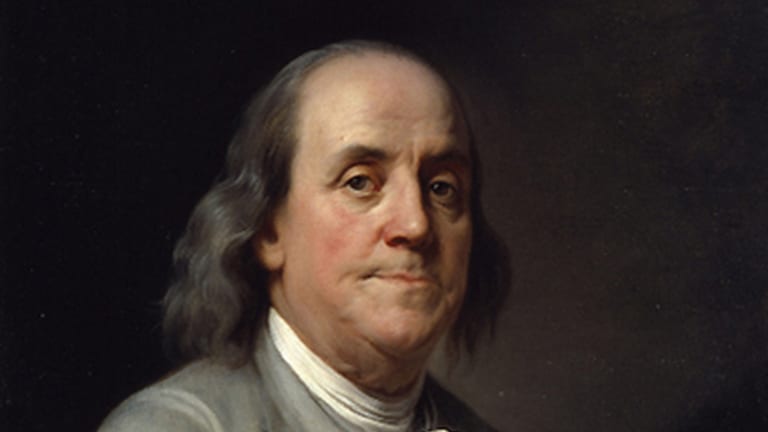

It's time to change your mindset. Here are some success quotes from some of the world's successful people. "In the middle of difficulty lies opportunity" Albert Einstein - Theoretical physicist who developed the theory of relativity, one of the two pillars of modern physics. Price is what you pay for. Value is what you get Warren Buffet - American investor, business tycoon, and philanthropist. Known...

Direct property and direct shares are among the most popular investments to own. They both provide an investment return, but lets explore the advantages, disadvantages and what the main differences are between the two investment assets. Direct property For the purposes of this article we will discuss the advantages and disadvantages of residential property. A residential property includes houses, units,...

Property affordability has become a real challenge for many Australians. It has opened up many other strategic ways to buy real estate. One type of property investment is a timeshare. However are they really worth buying? What is a timeshare? A timeshare is a property owned by a divided share. Timeshares are common to properties such as hotels, resort, casinos, snow lodges to name a few. The ownership...

When leasing a property most would recognise it as the biggest expense in your budget. What ways can you pay rent? If you are unable to cover your monthly rent, the landlord can issue a notice to vacate. In this article we outline what ways you can pay your rent which may best suit your circumstances. Direct Debit: The most common preferred payment for a property manager is an automatic transaction. The...

When we buy a new home we spend a lot of time in the kitchen. How we have grown to love kitchens. If it’s cooking, cleaning or even entertaining. This is where a common question arises. Benchtops - stone versus laminate. Is it better to include stone or laminated bench tops? There isn’t necessary a right or wrong answer but here are some differences you may want to take note before your next...