Have you ever considered buying a property off the plan? Why would we choose to buy off the plan? Most people love the smell of a new home... The new floorboards, the silky stone benchtops, the spacious new walk-in-robe or that inspiring hot tub!! There are many amazing things to love in a new property. There are also various financial benefits. However, these can differ depending on the type of...

Market Insights

As apartment and townhouse living continues to become a widely popular choice among younger buyers creating useful spaces are ideal. The study nook is one of those great innovative areas. In response to covid-19, many are now working from home. A study nook creates a separate spot to work or study in the home. It can feature a desk, drawers, and a great in built shelving area are great to store books...

Melbourne remains a popular place to call home. Toorak continues to rank the most expensive suburb with a median house price of $3,600,000. Canterbury and Hampton come in nearly a million dollars left to take second and third spot. The majority of suburbs are within a 20km radius of the Melbourne CBD represent the bulk of suburbs surpassing the million dollar price. Here is a currently list as at the...

The Melbourne property market has experienced some of the most extraordinary circumstances with the wake of covid-19. For the most part, the market has remained steady. Much of this has been with the help of some government incentives and banking support. Here is some interesting property data outlining median house and unit prices. Top Growth Suburbs by Median House Price Top Growth in Median Unit...

Covid-19 isn’t going anywhere fast and the reality is we may have to get used to this for a while. How to plan your day during covid-19. For many of us the biggest struggle isn’t failing to get things done, often the problem is poor motivation, distractions and time management. It can happen to anyone when they start to work from home or spend more time straying from their regular routine. Here...

A roof top terrace is a growing amenity among new modern apartments. Having an amazing view of the Dandenong mountains or twilight views of the Melbourne city skyline are undoubtedly a pleasure. However is it worth it? Some roof top terraces have teppanyaki kitchen appliances or barbecues, a garden terrace and outdoor furniture. Larger apartment buildings can also include a swimming pool, cinema or...

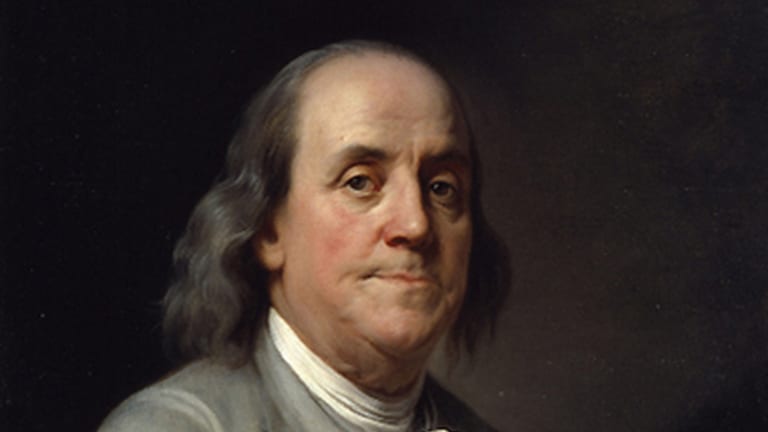

It's time to change your mindset. Here are some success quotes from some of the world's successful people. "In the middle of difficulty lies opportunity" Albert Einstein - Theoretical physicist who developed the theory of relativity, one of the two pillars of modern physics. Price is what you pay for. Value is what you get Warren Buffet - American investor, business tycoon, and philanthropist. Known...

This is the latest Rental Market Snapshot as at June 2020. Here we highlight, metropolitan Melbourne and regional Victoria. According to the The Real Estate Institute of Victoria (REIV) :- The proportion of vacant properties in metro Melbourne has increased from 2.3% in March 2020 to 3.0% in June 2020. The proportion of vacant properties in regional Victoria decreased from 1.9% in March 2020...

Direct property and direct shares are among the most popular investments to own. They both provide an investment return, but lets explore the advantages, disadvantages and what the main differences are between the two investment assets. Direct property For the purposes of this article we will discuss the advantages and disadvantages of residential property. A residential property includes houses, units,...

Property affordability has become a real challenge for many Australians. It has opened up many other strategic ways to buy real estate. One type of property investment is a timeshare. However are they really worth buying? What is a timeshare? A timeshare is a property owned by a divided share. Timeshares are common to properties such as hotels, resort, casinos, snow lodges to name a few. The ownership...