The correlation between land-to-asset ratio and capital growth. Not all investors make note of this fundamental in their investment decisions. Some of the more experienced investors would have heard this term, but many don’t quite understand how to use it.

What is a land-to-asset ratio?

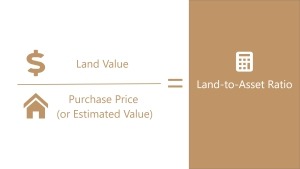

The land-to-asset ratio is a fundamental criteria that helps to assess the quality of an investment property with the emphasis of determining its capital growth potential. It is the proportion of the overall property value made up of the land component. Below is the formula used to calculate it:

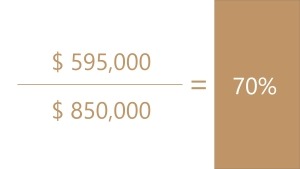

To simplify this, if a property was purchased for $850,000 and the land value was $595,000, the land-to-asset ratio would be 70%. As you can see in the below image.

How to determine the land-to-asset ratio

The assessment can present capital growth opportunities because rising land values are the primary driver of price growth. The building/dwelling is generally seen to be depreciating in value. For this reason, it ideal to have a higher component to land in your property purchase.

To determine the ratio, you need to know the land value. An efficient way to do this, is understanding the average land value per square metre in the suburb you are looking to invest. Then multiply the figure by the square metres of the particular property you are looking to purchase.

Another alternative is to source a vacant block of land recently sold and divide the sale price by the total square metres of the land.

Now that you know what the land value is, you can then determine the percentage of the estimated purchase price figure made up by the land component.

What is a good land-to-asset ratio?

If we look at this in the view of a property investment, a good ratio would be anything over 50%, however the higher the better. At Crest Property Investments we aim to achieve a 70% ratio. We believe the higher the ratio, the higher the potential to achieve capital growth. Please note, the building/dwelling also has a value. A good quality build will improve the appeal of the block and compliment the capital appreciation. It is for this reason, that a 50% ratio can also provide the equivalent result to a 70% ratio. Each property, location and purchase amount must be determined on its own merits. It is very much a case by case scenario.

One mistake many property investors encounter is the emotional side of making an informed decision. Some make a decision based on opinion over fact. The land-to-asset ratio can help alleviate or reduce the emotional attachment. There are a number of fundamentals that should drive your decision on what you should buy, with the land-to-asset ratio being one of the influential contributors.

How not to use the land-to-asset ratio?

A larger block of land, doesn’t necessarily mean, it has a higher land-to-asset ratio. In fact this is the ultimate way not to use this fundamental. The other question raised is should we buy a vacant block of land (with no home)?

We would generally say ‘no’. A vacant block of land does not earn a rental income and has no tax deductible expenses. If you’d like to learn more on how to determine and assess rental yields click here. The loan repayments are also deemed non-taxable. This is on the basis that land does not generate an income and therefore is not eligible for any tax entitlements. Land is also rather scarce if we look to source it in high demand areas, particularly in good proximity to the city, schools, amenities etc.

Don’t be mislead that bigger is better. A larger block of land doesn’t always mean more capital appreciation. Location is still paramount. Buying a huge block with the hope of subdividing sounds nice in theory, but this isn’t easy as one thinks. The location of the property is still more important and influential to appreciate in value over the size. Buying in the middle of no where may not offer any capital growth at all.

What are the disadvantages with properties with a high land-to-asset ratio?

There can be disadvantages of properties that have a high land-to-asset ratio. The rental yield is likely to be lower, as its difficult to rent a house on a large block much higher than a traditional house and land. Essentially the dwelling generates the rental income where as the land helps generate capital growth. This is where your property assessment should be done with balance. Capital growth and rental income can outperform each other at different intervals. The rental income is particularly helpful if you want assistance in paying the investment loan (if applicable), while retirees may rely on the passive income to support their living expenses in retirement.

Another point to consider is the tax entitlements. Property investors are very lucky to be in a position to claim a variety of tax deductions, particularly the highly beneficial tax depreciation entitlement. The government allows investors to claim depreciation of a dwelling for up to 40 years because the dwelling is reducing in value over this period. The land component does not receive any form of entitlement.

What should I do?

There are other contributing factors and common themes seen in what capital growth properties have in common. Including the land-to-asset ratio is one part of the overall assessment but their are other valuable commodities to be used. Before buying a property, we recommend seeking professional property advice. At Crest Property Investments we specialise in sourcing brand new and off the plan properties for buyers. We also do not charge fees to buyers! If you’d like to learn more, please feel free to contact us. We welcome the opportunity to help you make the best property decision.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more please contact us. We welcome the opportunity to assist you.

February 2022