What capital growth properties have in common. When buying an investment property, we all make the decision on the basis of making money. Property investment offers three unique returns, rental (income), tax entitlements and capital growth. In this market insight we highlight the common themes that are seen in a properties that receives capital growth.

1. A good location

One of the most influential contributors to capital growth is location. It can be a word thrown around without truly appreciating the importance. Buying property anywhere does not enjoy the same capital growth, however not one location will outperform continuously. When choosing a location, there are a number of fundamentals to consider. Some are more important to others, but you need to do your due diligence carefully. During the period of 2021, we saw some outer suburban areas and regional parts of Victoria outperform. This does not mean it will continue, so you must review up to date facts and figures. At Crest Property Investments we pin point many different factors and have a scoring sheet. A property must score over 75/100 before its presented to a client. The higher the ranking, the greater the capital growth opportunity.

Many home buyers feel pricing affordability is the primary focus on a good suburb or purchase. This has some merit but it will restrict you to certain areas or properties that may not offer your desired results. There are influential factors to consider including a walking score, amenities or schools to name a few.

2. Property choice

Not all property types perform the same. In reference to the residential property market, you generally have a choice of apartments, townhouses and standalone homes. There are of course some others, but these are the three most common. Each property type presents different characteristics but you’ll find standalone homes and/or townhouses often see experience better capital growth. The land component, further discussed in the next point, is a centre point to capital growth. A larger home, doesn’t mean it will appreciate in value more than a smaller home, so careful decision making is still in order.

3. Understanding the land component

The land to asset ratio is the proportion of the overall property value made up of the land component. To explain this in figures – A property valued at $750,000 with a land value of $450,000, the land to asset ratio would be 60%. The land component is a big contributing factor to achieving capital growth. The larger the land, the more demand it may have, particularly from families and/or developers looking to subdivide. Not all areas can be subdivided so make sure you understand this before buying or selling.

If you are renting out an investment property, rent doesn’t necessarily increase in line with the land component. This means a 5 acre block in region Victoria won’t necessary increase in value by more than a standalone home on a smaller block of land situated 10 mins from the Melbourne CBD. Each property must be reviewed case by case. Don’t get caught up that size matters. Land located in a good location will appreciate more in value, than a property situated in an unfavourable location.

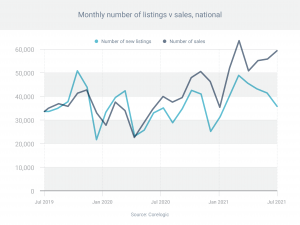

4. Demand outstripping supply

When demand outstrips supply, this placed upward pressures on prices. In other words increases the prospect of generating capital growth.

Below is a graph that highlights the recent trends through the last two years.

5. Development and council activity

Investors can well benefit from the infrastructure that comes from both property developers and council/government activity. As investors, you should be following the trends where governments are spending. With schools, town centres and various amenities in the pipeline, it increased demand and in turn provides a higher chance of capital growth.

When developer receives an approval to build a master planned community, you’ll often see that the council have agreed to work with the developer to enhance the liveability of the area. You may see new train stations, you may see new freeway entrances or better public transport.

Be mindful when you follow these trends. In many cases, you may be paying a premium to buy in that particular area because of the expected changes. You will need to assess this carefully.

What should I do?

There are other contributing factors and common themes seen in what capital growth properties have in common. Before buying a property, we recommend seeking professional property advice. At Crest Property Investments we specialise in sourcing brand new and off the plan properties for buyers. We also do not charge fees to buyers! If you’d like to learn more, please feel free to contact us. We welcome the opportunity to help you make the best property decision.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more please contact us. We welcome the opportunity to assist you.

January 2022