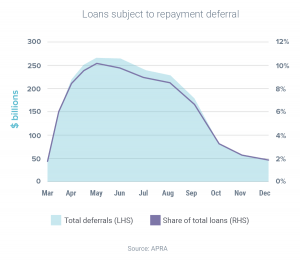

Mortgage deferrals continue to drop. According to new research from Australian Prudential Regulation Authority (APRA) it seems many Australians are once again managing to pay their own mortgages. Back in May 2020, there were approximately 10% of of borrowers needing to pause their loan repayments.

In December 2020, borrowers needing to pause their loan repayments were down to approximately 2.4%. The below graph from APRA summarises what happened between March 2020 through to December 2020.

As a result of the global pandemic, many Australian were heavily impacted emotionally and financially. The government offered a number of entitlements to help Australians meet their financial requirements and offered many other services to help the emotional turmoil that was being experienced.

The banks were also offering support by allowing borrows in financial distress to pause their mortgage repayments (generally for 6 months). This helped many Australians to support themselves and their families. In accepting to pause your mortgage repayments, the interest expense was compounded on top of the loan balance. Basically, loan balances increased as they were unable to pay their mortgage.

Most mortgage repayments were paused in March 2020, when many parts of Australia were impacted by covid-19. Deferred loan repayments peaked in May 2020 but has fallen steadily.

If you would like assistance in reviewing your financial circumstances, please don’t hesitate to contact us. We can introduce you to a mortgage broker who can come to you.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more please contact us. We welcome the opportunity to assist you.

March 2021