Many of us fall into the category of buying a new property before your existing home has been sold. A bridging loan bridges the gap between securing a mortgage for a new property before an existing property is sold.

It’s very exciting when upgrading your home, but if it’s subject to selling your current property, it can be an anxious and stressful wait. Aligning these two timelines to match can be difficult, but funding the purchase may be easier than first thought. A bridging finance loan may be a solution that can assist in the process.

How does a bridging loan work?

A practical way of demonstrating the fundamentals of a bridging loan is to discuss a case study example.

Dennis owns a property that he is currently selling. Dennis has sourced the perfect property to house his growing family and within walking proximity to their school. At this stage he is committed to buying this new home, but he hasn’t found a buyer for his existing home.

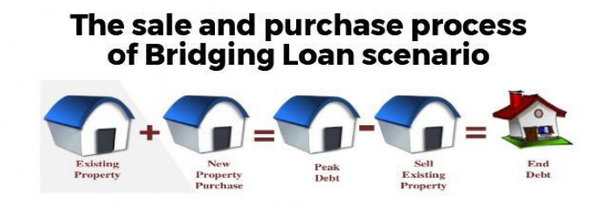

The current home has a mortgage of $300,000 and he’s looking at buying a new property at a total cost of $600,000. Dennis can borrow 100% of the purchase price,which allows him to borrow a total loan balance of $900,000. This total loan amount is known as ‘Peak Debt’. The ‘Peak Debt’ is a short term loan arrangement while Dennis finalises the sale of his current home.

Dennis finally executes the sale of his existing home. He sells it for a net amount of $500,000. This proceeds are then used to reduce the ‘Peak Debt’ from $900,000 to $400,000. This new loan balance is then known as the ‘End Debt’ and will essentially become a standard mortgage of $400,000.

Who should we consult to get a Bridging loan?

Looking at the above case study the use of a bridging loan allows you to secure your new home sooner without the stress of paying two full mortgages at once.

We suggest you review your borrowing capacity in advance, ensuring you are eligible for a bridging loan. You can consult a bank directly or meet a mortgage broker. We believe employing a mortgage broker as a better option. They can review your circumstances and advise which lender is right for you. Many lenders offer varying incentives so we recommend you discuss this with a licensed mortgage broker. If you do not have one, we can refer you to a professional who can meet you in your home.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more, please contact us. We welcome the opportunity to assist you.

Oct 2018