When buying an investment property, one of the many contributors that makes property the best investment are the tax benefits achieved when implementing a negative gearing strategy. It shouldn’t be the sole reason to invest in property, but its something that should be taken into consideration when making an informed decision.

If you are a property investor, you’ve probably learnt a little about the term negative gearing. In this market insight, we take the opportunity to provide some detail around the difference between negative gearing, cash natural and positive gearing. Not one particular strategy suits all, so we recommend seeking professional advice from an accountant or tax agent.

What is negative gearing?

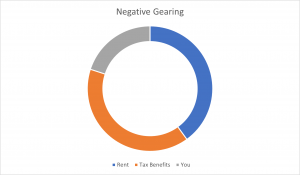

Negative gearing is when your investment property generates a rental income less than your loan repayments and other outgoings costs. Outgoings may include, council rates, insurance, owners corporation and/or water rates to name a few. To be in a negative geared situation you are essentially earning less income in comparison to the overall holding costs to have the investment property.

Why would investors choose this strategy? There are many underlying reasons, but effectively an investor anticipates the capital growth to outperform the overall costs over time. This type of investor will be placing less emphasis on rental return and focus on generating capital growth. The tax benefit associated with negative gearing is the loss associated with the property can be offset against other income earned. This reduces their assessable income and in turn pays less tax. Another way of implementing a negative geared strategy is to buy a brand new home as it will receive a tax depreciation entitlement. Tax depreciation expenses are not actual cash expenses. They are known as a non-cash entry.

What is a cash neutral strategy?

An investment property implemented with a cash neutral strategy effectively means it generates no net cash. The rental income is offset by the loan repayments and other outgoings costs. Keeping a cash neutral strategy means having the rental income fully deployed to covering the holding costs.

Why would investors choose this strategy? There are many underlying reasons, many investors prefer not to be paying anything regularly to keep the property, particularly if they have other personal expenses to look after. The cost of tax is minimal as the property demonstrates a non taxable result. This can be helpful for some people wanting to reduce the worry of paying the loan and the tax at a particular time.

What is positive gearing?

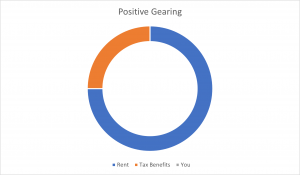

A property is positively geared when the rental income is more than the property expenses including interest on the loan. If the annualised rental income was $25,000, the interest payment on the loan was $15,500 and the outgoing costs were $2,500, you are effectively generating a positive cash flow of $7,000 over the course of the year. This principle is known as “positive cash flow”.

Investors with positive cash flow properties consider the benefit before tax rather than relying on tax deductions. Positive geared properties are when the rental return is higher than your loan repayments and other outgoings after consideration of depreciation and other tax deductions.

What strategy is best?

There is no such thing as which is best. The beauty of property investment, is the fact investors can alter their strategy to suit the individual circumstances. You may want to potentially start with negative gearing if your marginal tax rates are high and later covert it to a cash neutral position if you have other costs to adhere to or the fact you may want to buy another property. The positive cash flow can then be adopted later when you plan to eliminate the debt and look to live off the rental income at a later date.

Risks of borrowing to invest

Borrowing to invest, regardless if its property, shares etc. increase the risk of investing. A geared investment strategy will receive magnified gains and losses as you are using additional funds to buy an asset. When it comes to property investment, it is vey important that you borrow sensibly and ensure you are in a position to meet the costs in the event you are not receiving a rental income. Seeking advice from a mortgage broker or a financial planner will help you identify what your borrowing capacity is and learn what can afford before committing to such a strategy. It can fast track your investment plans, but careful consideration is needed.

It’s also important to acknowledge that different property types and/or location will also play a large factor if you plan to adopt a particular strategy. Before investing into a property, we recommend seeking professional property advice. At Crest Property Investments we specialise in sourcing brand new and off the plan properties for buyers. We also do not charge fees to buyers! If you’d like to learn more, please feel free to contact us. We welcome the opportunity to help you make the best property decision.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more please contact us. We welcome the opportunity to assist you.

September 2021