Buying a property can be cheaper to renting. This is a topic raised by many people given the fact interest rates are at all time lows. According to recent data collected from CoreLogic identified buying a property can be cheaper than renting for 36.3% of homes across Australia. That equates to over a third of properties.

CoreLogic previously completed this analysis in February 2020. It was determined at that time, it can be cheaper buying property than renting for 33.9% of homes across Australia.

In assessing the basis behind “buying a property can be cheaper to renting”, it essentially means it costs less to cover the monthly mortgage repayments in comparison to the monthly rental payments in the same location. In their analysis they also assume that the loan balance is 80% of the property value, the loan term was set to 25 years and the interest rate was 2.40%.

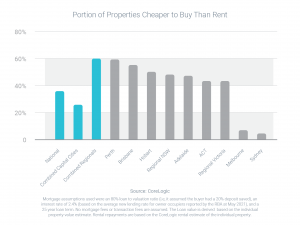

The graph below highlights the portion of properties to buy than rent. Its important to note that their nation analysis may have some discrepancy with regional locations and metropolitan suburbs valuing very different.

At Crest Property Investments we monitor various property data when sourcing brand new and off the plan properties for buyers. The data below isn’t something you should rely on when making a decision to purchase a property, particular as everyone’s personal circumstances aren’t the same. Finding a 20% deposit to access a loan balance of 80% can be challenging for some people, particularly first home buyers.

If you would like to learn more about property investment or would like to discover what’s appropriate for you, please don’t hesitate to contact us. We offer a free service to buyers.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more, please contact us. We welcome the opportunity to assist you.

August 2021