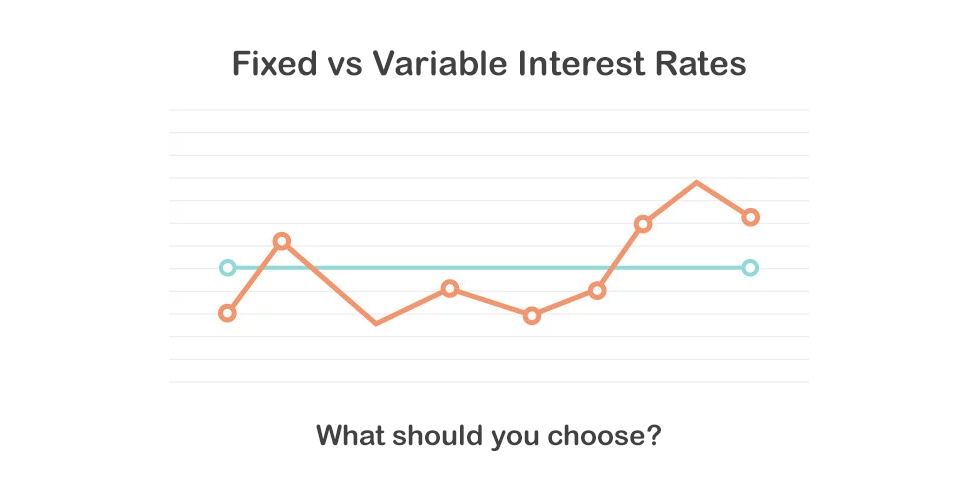

For people in the property market, a large consideration to work through prior to buying a property is which type of mortgage to apply for. Mortgage Choice published a useful article highlighting a hot topic in the current market. Do we lock in a fixed interest rate or do we ride out a variable interest rate?

If this is you, you’ll need to carefully consider the following points. Obtaining lending advice from a mortgage broker would be ideal.

- Are interest rates going up or down?

- If they go up, when will this happen and how much will it cost?

- If they go down, when will this happen and how much will we save?

- If they remain stagnant, what are the market interest rates?

Unfortunately, no one can dictate the movements of interest rates. There are many factors taken into consideration by the Reserve Bank of Australia. Discussing the opinions from professionals may certainly provide some guidance and allow you plan ahead over the next 6-12-18 months’ at a time.

Mortgage Choice highlighted some very interesting statistics. Reviewing the major states in Australia, who opted to select fixed interest rate loans over variable interest rate loans. During the month of March, New South Wales had the highest number of fixed interest rates at just under 26%. Queensland was ranked second with approximately 24% locking in fixed interest rate loans. Borrowers in Victoria were the least likely to fix their interest rate, with only 14%.

Fixing a home loan isn’t right for everyone. There can be restrictions in paying down your loan sooner, but many lenders differ from one another. With a large landscape of lending products to choose from, we highly recommend speaking to a mortgage broker.

Nevertheless, these market insights are a very interesting indeed.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more please contact us. We welcome the opportunity to assist you.

April 2019