In Melbourne, did you know the State Revenue Office of Victoria (SRO) orders over 300,000 property land tax assessments each year?

Calculating property land tax can be a complex assessment. In our experiences, even experienced property investors find it difficult to comprehend. At Crest Property Investments we educate our clients prior to purchasing. This is a topic we discuss early and collaborate with accountants and conveyancers.

What is a property land tax assessment?

Each state is governed and assessed differently. In Victoria, a property land tax assessment is applied if the taxable value of your land exceeds $250,000. This includes land owned by a trust or jointly owned with others parties. The property land tax assessment values the property site, which is then used to produce your land tax liability.

Are there any exemptions?

Land tax is typically applied to investment properties. The home you occupy, also know as the “principle place of residence” is exempt from land tax. Other land exempt for property land tax are farmlands, as the are used as primary production, and land used by charities.

If you’re unsure whether you are liable to pay any property land tax, we recommend you consult your accountant and/or conveyancer. They can calculate the land tax based on the threshold amount. The SRO’s website also features a handy online tool that can assist you further.

- Agricultural shows and farm field machinery days

- Armed services personnel

- Caravan parks

- Crown land

- Friendly societies

- Health centres and services

- Land leased for outdoor sporting, recreational or cultural activities by members of the public

- Mining

- Municipal and public land

- Public statutory authority

- Residential care facilities and supported residential services

- Residential services for people with disabilities

- Retirement villages

- Sporting, recreational or cultural land owned by certain non-profit organisations

Property land tax rates:

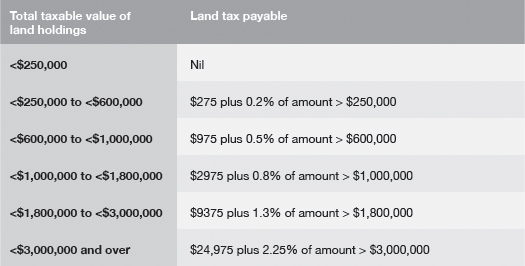

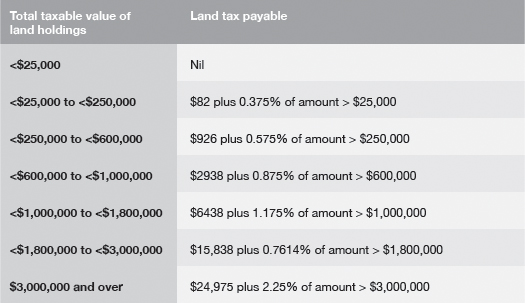

The property land tax thresholds in Victoria differ for general rates and trust surcharge rates. These figures have been sourced from the SRO – https://www.sro.vic.gov.au/landtaxrate

General Rates:

Trust Surcharge Rates:

Please note these figures are based on current data sourced in April 2019.

Learn more about land taxes

As the Melbourne economy grows so will the property market. With the increasing population property prices will over time continue to accumulate. This could invariably mean larger taxes for land owners. As a result, we recommend consulting a qualified professional. Please contact your accountant or conveyancer for more details. It would be appropriate to discuss your tax obligations prior to purchasing and/or selling.

We have close affiliations with many trusted professionals. If you’d like an introduction, please don’t hesitate to contact us.

The SRO is also another excellent source who can help you understand your obligations around property land tax.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more please contact us. We welcome the opportunity to assist you.

April 2019