How to understand median property prices. When buying property, we all carefully complete our due diligence. We all want to make the right decision and we do the best we can to review the property market. One indicator that can mislead your decision making is observing the change in median property prices.

Median property prices are one of the most viewed statistics in the property market. It is very assessable and generally easier to read. However, with any form of statistic there are various factors often overlooked. At Crest Property Investments we review various statistics when assessing property opportunities. The median property prices is one, but you need to better understand this before drawing any conclusions.

What does the median property prices mean?

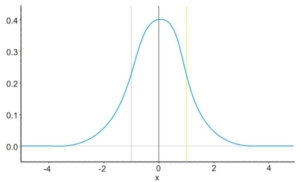

The median property price is the midway point of all the houses/units sold at market price (or sold amount) over a set period (monthly, yearly, quarterly, etc.) This list of sales is arranged in order from lowest to highest price.

Looking at the graph above, if there were 9 property sales in a prescribed month, the median property price would be determined by the sale price of house number 5, which has 4 lower priced sales 4 higher priced sales.

This differs from reviewing the average sales prescribed in the same month. The average calculation would be determined by the total value of all the properties sold and divided by the number sold.

The median calculation is more accurate than the average calculation as it is less affected by any anomaly sales that may have taken place. For example a property may be sold with a permit to subdivide a multi development taking the asking price above what is normally seen. Median prices are based on the homes that have recently transacted, and are most often divided into units and houses.

A change in median price does not necessarily change your property value

The change in median property prices reflect the activity in the property market as apposed to property valuations. If you see the median property prices in your suburb has decreased this does not mean your property has decreased. All suburbs have different property types and differing values due to size, land etc. In a prescribed month, there may be more units sold over houses. This would naturally decrease the property median prices. However than does not mean the million dollar homes have dropped due to the recent activity of lower priced sales.

If the median property price increased due to some sold large luxury homes in a particular month, this would not mean that an Apartment or Townhouse has had a massive increase. Overall, median property prices don’t necessarily reflect rising property valuations. If you aim to use median housing prices to contribute to your decision making, you’ll need review this further by ascertaining what type of sales occurred. You need to discover if the property featured 2 bedrooms, 3 bedrooms, 4 bedrooms, carport, garage etc. This will help you compare ‘apples with apples’.

Median property prices are different everywhere you look

If you have spent some time reviewing the median property prices, you have probably noticed that they differ from where you have read them from. This doesn’t mean they are incorrect, but the data they are using will result into different figures. Generally the interval dates may be different. They can be viewed daily, weekly, monthly, quarterly and even yearly. Where the data has been sourced will also cause a variation.

Research should be reviewed long term, not just on recent activity

Statistics should be viewed over the long term. However, performance is better compared over lengthy periods. The most successful investors buy property and hold long term. Unless you are a property developer, but even these type of investors often hold one of the properties within their development long term.

When using median property prices they are often better used as an indication of the composition of sales as apposed to changing property values. If you are a first time or experienced investor, looking for a property adviser to source the right investment property for you, please feel free to contact us.

Our YouTube channel and Market Insights also provide a wealth of information to assist you with many areas relating to property investments.

May 2019